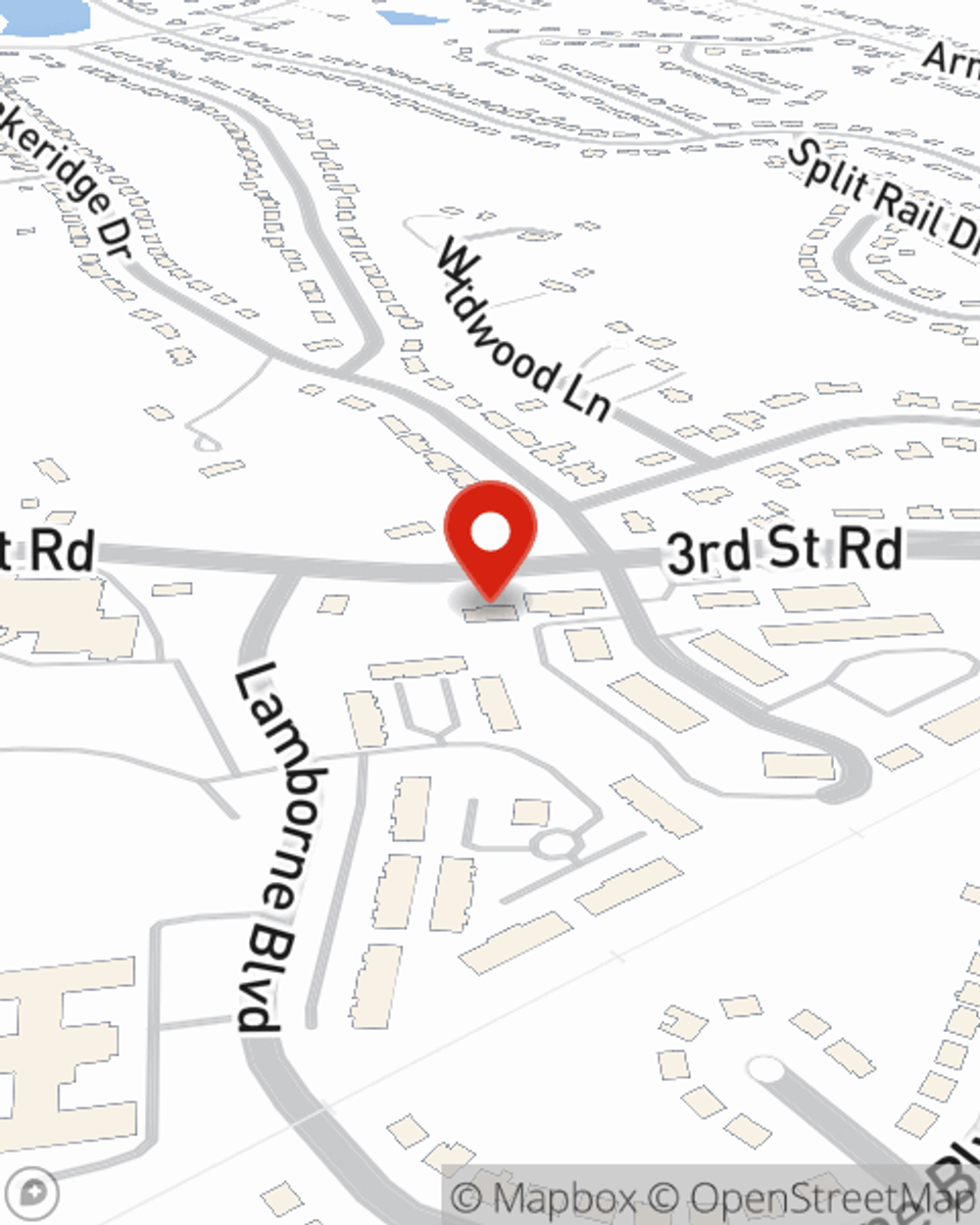

Business Insurance in and around Louisville

One of the top small business insurance companies in Louisville, and beyond.

Helping insure small businesses since 1935

- Kentucky

- Louisville

- Elizabethtown

- Brandenburg

- Fairdale

- Valley Station

- Indiana

- Jeffersonville

- New Albany

- Clarksville

Insure The Business You've Built.

You may be feeling like there's so much to think about with running your small business and that you have to handle it all by yourself. State Farm agent Naomi Stevens, a fellow business owner, recognizes the responsibility on your shoulders and is here to help you personalize a policy that's right for your needs.

One of the top small business insurance companies in Louisville, and beyond.

Helping insure small businesses since 1935

Protect Your Future With State Farm

For your small business, whether it's a bakery, a pizza parlor, an arts and crafts store, or other, State Farm has insurance options to help fit your needs! This may include coverage for things like accounts receivable, loss of income, and business liability.

Reach out to State Farm agent Naomi Stevens today to explore how one of the leading providers of small business insurance can ease your worries about the future here in Louisville, KY.

Simple Insights®

Steps to start a small business

Steps to start a small business

Starting a small business can be exciting and challenging. Use this guide to help turn your idea into a successful business.

How to collect rent from tenants

How to collect rent from tenants

There are many ways to collect rent from your tenants. It's important to consider the one that best suits your needs.

Naomi Stevens

State Farm® Insurance AgentSimple Insights®

Steps to start a small business

Steps to start a small business

Starting a small business can be exciting and challenging. Use this guide to help turn your idea into a successful business.

How to collect rent from tenants

How to collect rent from tenants

There are many ways to collect rent from your tenants. It's important to consider the one that best suits your needs.